Asia's Premier Financial & Accounting System

Managing Financial Performance to Drive Profitable Growth

Overview

A full-featured financial management software (FMS) for integrating General Ledger, Accounts Receivable and Accounts Payable through double-entry. This award winning accounting software also contains a broad set of functionality to handle bookkeeping, multi- currency, multi- location, inter- company transaction, consolidation, budget control, auditing, multi- dimensional analysis.

Manage Finances With FlexAccount And Celebrate Success

Complete Accounting Software That Simplify Financial Processes, Closing and Reporting

-

General Ledger

General Ledger is the backbone of an accounting software. This double-entry booking system ensures that all accounts are always in balance. It integrates G/L, A/R, A/P from throughout your business and helps you monitor the fiscal health of your organization in real time. It maintains financial information as well as budget information and all transaction history from all other modules in single one location.

-

Configurable Hierarchy Setting

User can structure multi-level hierarchy, grouping rules and unlimited number of ledgers in FlexAccount system. It avoids the pain of reworking accounting and consolidation process. Since user can define account code and analysis code, FlexSystem accounting software enables user to generate reports from different dimensions, e.g. job, profit and cost center analysis. User can view every activities of each account with drill-down function. Allocate any entry over multiple accounts can based on predefined allocation rules to reduce the time to data entry.

-

Multi-Layers Budget Management

Monitor the budget of General Ledger activity within the organization has never been so easy. User can define budget at company, department or cost center level in FlexAccount software. In order to gain better control of budget, user can set budgeted amount for each account and FlexAccount will then automatically send alerts if any account over budget.

-

Effortless Bank Reconciliation

Simplify the process of reconciling your account balances with bank statements. For each bank account, you can import the statement information directly from electronic bank file and reconcile it with cash account transactions in the accounting software.

-

Accounts Receivable

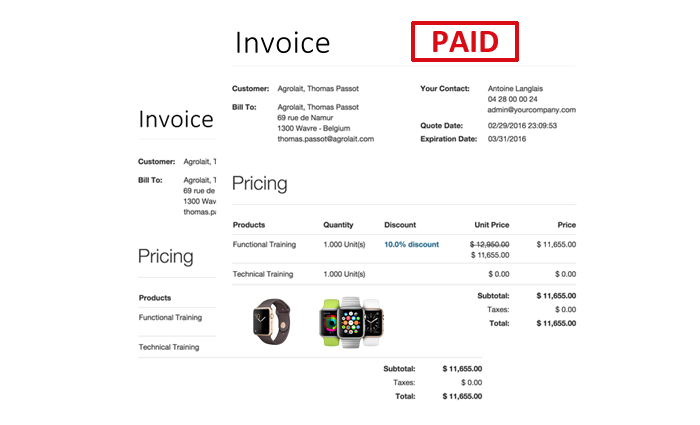

Accounts Receivable manage receivables and automate the billing process. Keep track of outstanding balances, schedule recurring invoices, and take control of your cash flow automatically to smooth your AR management.

-

Reduce Bad Debts

User can set up and schedule billing automation for recurring invoices on regular basis to avoid rapid invoices entry. Support several types of charges including late charge and minimum charge, etc. Support multi-currency, user issue customer invoices and collect customer payments in different foreign currencies. The accounting software will calculate the exchange gain/loss and currency revaluation automatically.

-

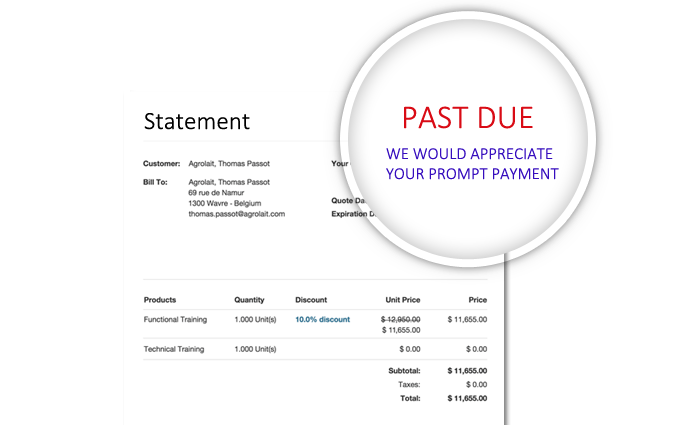

Credit Control

Implement credit limits when you issue invoices to minimize the risk of uncollectible debts. User can specify a credit limit amount and a maximum overdue period for each customer and alerts will be sent if an order over the credit limit. In additions, outstanding invoices' reminders or statement can be sent from the accounting software to co-respondent person to take further action.

-

Get Full Insight On Debtor Accounts

Monitor your account balances with on-line inquiry features. User can access real time detailed debtor's information instantly at your fingertips with drill-down and key word searching functions, including payment history, transaction activities, status, payment terms, price, etc. Debtor aging analysis and other sophisticated reports enable you to get in-depth understanding of your debtor accounts.

-

Accounts Payable

Accounts Payable empowers you the control and flexibility to execute payables processing, manage expenses and statistical financial data, predict cash flow and vendor analysis.

-

Automate Payable Process

Set up payment schedule for recurring invoices to be paid on regular basis. Streamline repetitive and rapid transactions entry and thus significantly reduce workflow and minimize human error. Moreover, various payment terms can be defined and applied automatically or manually to adopt unique business requirement, e.g. early pay discount.

-

Flexible Payment Method

The accounting system support both electronic payments and paper cheque handling. In addition the cheque printing function linked with payable accounts. User can issue a cheque for a specified invoice or summary cheques and all issued cheques are recorded. This feature enables user to trace back which invoice is settled by a specific cheque for internal control or auditing purpose.

-

Visualize Your Financial Situation

Accounts Payable provides timely and accurate information on cash flow, aging information, due date, etc. With access to real-time vendor information, payment history, and vouchers, you are able to constantly review vendor and negotiate with better contract terms. Moreover, various cash projection reports assert control of your financial situation.